TRUST ACCOUNT REVIEWS

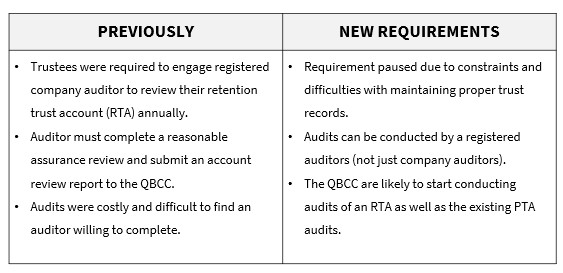

There were changes made on 1 July 2024 to the Trust Account Review requirements.

WHAT HAS CHANGED?

The requirement to conduct an annual audit of the retention trust account (RTA) has been paused.

WHY?

Trustees were having trouble finding suitable auditors and the audits conducted were hindered by the lack of suitable software available and difficulty in maintaining compliant records.

How long is the requirement paused for?

For 12 months, until July 2025 – pending improvements to software capability and industry readiness.

Will my account be checked?

The QBCC will continue monitoring and auditing trust accounts to ensure compliance. To date the focus of the approved audit program has been on project trust accounts (PTAs), this will now change to include a broader focus on RTAs as well.

Does this only apply to new retention trust accounts?

No, the pause applies to all trustees, regardless of when the account was set up.

What if I had an audit due/have already engaged an auditor to complete a review?

If no auditor was engaged by 1 July 2024, an audit is not required, but QBCC are likely to audit the account.

If an auditor was engaged and is conducting a review, the report must be completed and submitted to the QBCC.

Other changes

There are other changes that were made to the auditing requirements that will have an impact when the annual account review requirements are re-introduced in 2025. These include:

- audits can be completed by a registered auditor, not just a registered company auditor

- the requirements for what the account review report must include have been simplified; and

- trustees can apply for an exemption from carrying out a review if:

- there have been no new transactions or changes in the account during the review period; or

- there were no funds held in the account for the period (existing exemption).

REMEMBER

Just because the audit requirement has been paused, it does not mean that you won’t be audited – it’ll be by the QBCC instead.It’s important to maintain compliance.

Need further information?

Please reach out if you have any questions or feedback – or just want to talk trusts!

Thanks kindly,

Laura and the Building Trusts team

Call 0481 194 000 or email laura@buildingtrusts.com.au.