MONTHLY TRUST ACCOUNT UPDATE – OCTOBER 2024

Here’s a copy of what was sent to parties that are subscribed to our monthly trust account update.

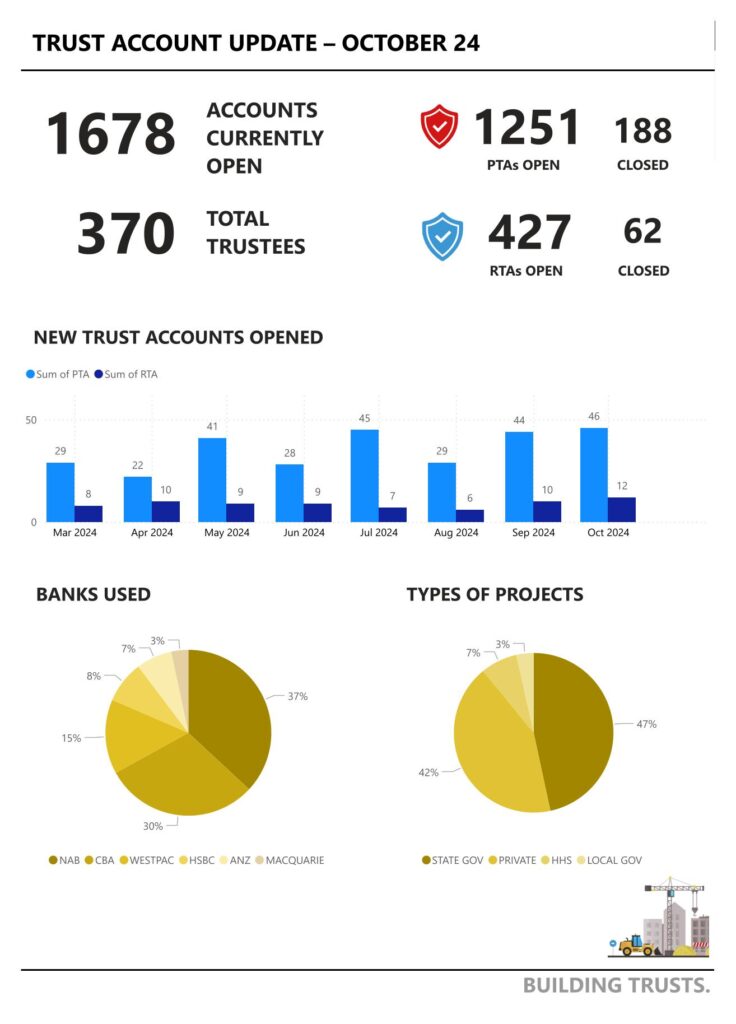

OCTOBER Queensland trust account statistics

It was another busy month, with 58 new trust accounts opened – including 46 new PTA projects:

- Total Trust Accounts: 1,678 currently open

- Trustees: 370 builders and developers managing active trust accounts

- New Accounts Opened: 46 PTAs and 12 RTAs in October.

More detailed statistics are available in the attached PDF, which includes a snapshot of the information published on the QBCC Trust Account Register.

This Month’s Focus – The Trust Ledger

One common question is:

Why do I need a separate trust ledger when I’m already recording this information in my business ledger?

Below, we clarify why these additional administration and record-keeping requirements are necessary and what it’s actually designed to do.

Please note that it’s also a mandatory requirement to keep compliant trust records, including a separate trust ledger. Some software is still catching up, but this is what we’re working towards.

WHAT IS A TRUST LEDGER?

A trust ledger is a specific record that tracks all entitlements to trust funds – ie. who is entitled to what from a trust account.

The trust ledger consists of separate sub-ledgers for each beneficiary, the trustee and the bank account itself.

HOW IS IT DIFFERENT FROM A GENERAL BUSINESS LEDGER?

Unlike a regular business ledger, which records all financial transactions for a company, a trust ledger only tracks changes to entitlements for a specific trust account.

Yes, a separate ledger is required for each trust account.

WHY IS A TRUST LEDGER REQUIRED?

Keeping a trust ledger is important because it creates a clear, accurate record of trust money, protecting the rights of subcontractors and others who should be paid from that trust.

A trust ledger (and the trust account) is there to protect subcontractor entitlements in the instance of an insolvency.

The funds are safeguarded in a separate account and the trust ledger tracks entitlements for those funds, and those funds alone.

The trust ledger helps the trustee to know who is entitled to what from the trust account, at any point in time.

WHEN DO I NEED TO UPDATE THE TRUST LEDGER AND WITH WHAT INFORMATION?

The trust ledger must be updated within 3 business days of a “transaction”, that is an event or change that impacts a beneficiary’s entitlement.

Transactions include: receiving a payment claim, issuing a payment schedule or RCTI, being paid by the client, paying beneficiaries or transferring retentions into the retention trust account and topping up or withdrawing funds from the account.

WANT TO KNOW MORE?

Download the detailed Trust Account Ledger factsheet – link below.

Or contact us to see an example ledger or to find out what software can assist with trust account compliance.

Trust Account Training Session

Are you a new trustee struggling to navigate trust account requirements?

Join us for a half-day training session in Brisbane on Tuesday, 26 November. We’ll cover key requirements, common pitfalls, practical solutions, and compliance tips.

Here’s a link for more information or to register to attend the session:

Need further information?

As always, please reach out if you have any questions, feedback, or just want to discuss trusts!

Thanks kindly,

Laura and the Building Trusts team

Call 0481 194 000 or email laura@buildingtrusts.com.au.