WHAT ARE TRUST ACCOUNTS AND WHY HAVE THEY BEEN INTRODUCED?

Trust accounts are designed to help ensure that everyone is paid for the work that they do. They’re required for eligible construction projects in QLD.

In simple terms, a trust account is separate account that quarantines and safe-guards funds that are due to be paid to someone else.

If a trust account is required, it’s mandatory, not optional, and the trustee must open and use the account correctly.

TYPES OF TRUST ACCOUNTS

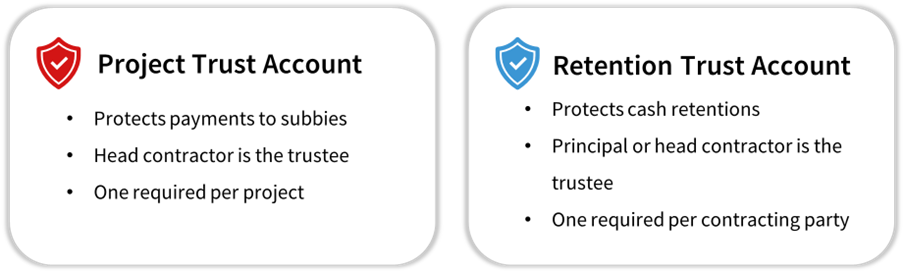

There are two different types of trust accounts. A project trust account and a retention trust account.

The project trust account is designed to protect subcontractor payments and must be established by the main builder (the head contractor) on a project. One project trust account is required per project.

The retention trust account is designed to protect any cash retention amounts withheld from payment for anyone that works on an eligible project. Currently, retention trusts are only required by the principal and the head contractor, but by 1 October 2025, any party withholding cash retention amounts from payment must hold them in a retention trust account. One retention trust is required per contracting party. It can be used to hold cash retention amounts for multiple parties across various projects.

In simple terms, a trust account is separate account that quarantines and safe-guards funds that are due to be paid to someone else.

If a trust account is required, it’s mandatory, not optional, and the trustee must open and use the account correctly.

THE BACKGROUND

The building and construction industry has long experienced payment and cashflow issues and has the highest rate of insolvencies out of any industry in Australia.

There have been various government reviews and recommendations for the implementation of statutory trusts which are like the existing solicitor’s or real estate agent’s trust requirements. Money that is for someone else is held in a separate trust account rather than the party’s normal business account.

Queensland has been the first to implement a far-reaching trust account requirement following a trial period with Project Bank Accounts (PBAs) for State Government projects valued between $1-$10 million back in 2018-2021. NSW currently has a retention trust requirement for projects above $20 million and WA a trust account requirement for certain State Government projects valued over $1.5million and an upcoming retention trust scheme from February 2023.

THE TECHNICAL PIECE

The QLD trust account requirements are outlined in the Building Industry Fairness (Security of Payment) Act 2017. They are statutory trusts under legislation meaning that they do not need to be registered other than with the QBCC and are not optional like other types of trusts.

There is a phased introduction of the trust account requirements to enable industry to prepare for the impact that they’ll have.

The new trust account framework commenced in March 2021 and has slowly expanded to include more parties and projects since. The latest phase of the roll out commenced on 1 January 2022 introducing trust accounts for private sector and local government projects. Further phases are due to commence in 2025.

There are strict rules for when a trust is required, where it can be opened, who must be told about the trust, when trust money can and can’t be touched and what records must be kept. It’s complex, it’s burdensome, and it will have a significant impact on your business.

Building Trusts can help you to prepare through detailed training, advice and support.