Who needs a trust account and when?

Trust accounts are required for eligible construction projects in QLD. Depending on who you are and what work you’re doing will impact if and when you need one.

What impacts eligibility?

- Who you are/where you are in the contractual chain

- The type of work being carried out/what is being built

- When the contract was entered into

- The value of the works being completed (total contract value)

- Whether cash retentions are being withheld

1. Who you are/where you are in the contractual chain

Let’s start with the different parties within the contractual chain:

Party

Description

Is a trust required?

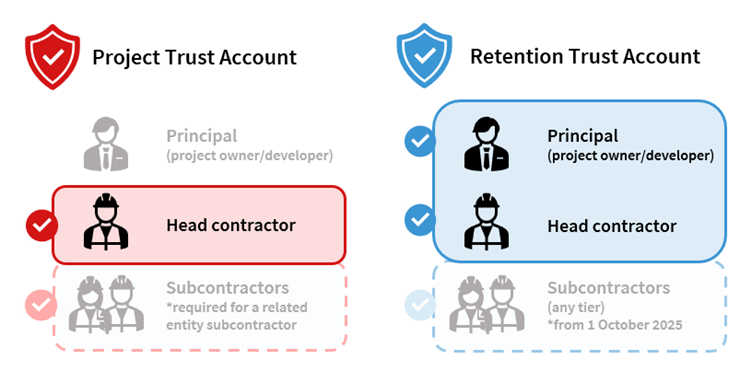

Principal

(project owner/developer)

The party at the top of the contractual chain who has organised for work to be carried out and/or are funding the work being undertaken.

The principal can be a public or private entity – for example the State Government, a statutory authority, a Local Government entity or a private entity such as a developer, company, land owner or corporation.

The principal may require a retention trust account if the project is a project trust project and they are holding cash retentions from the head contractor.

Head contractor

The party that is directly engaged by the principal to perform works under the head contract.

If the head contract meets the eligibility criteria, the head contractor must set up a project trust account for this project.

If cash retentions are being withheld from any subcontractors, a retention trust account must also be used.

Subcontractors

Parties who are engaged by the head contractor to assist with work related to the head contract.

For project trust projects, a subcontractor beneficiary is a party that carries out protected work or related services. They may be engaged via a formal subcontract agreement or a purchase order and are to be paid directly from the project trust account.

At this stage, subcontractors are not required to set up or use a trust account unless they are a related entity to the head contractor.

From 1 October 2025, a subcontractor may be required to have a retention trust account if they are withholding cash retentions from any parties engaged.

2. The type of work being carried out/what is being built

A project trust account is required for projects where 50% or more of the work to be completed is for “project trust work”.

What is project trust work? There’s a specific definition but generally speaking project trust projects can be work on the following types of buildings:

RESIDENTIAL PROJECTS

A set of 3 or more townhouses, an apartment block or unit complex.

COMMERCIAL AND INDUSTRIAL PROJECTS

A warehouse, shopping centre, office building, manufacturing facility, restaurant or café building.

GOVERNMENT PROJECTS

State and Local Government owned buildings – office buildings, education facilities, buildings for infrastructure facilities, public safety, etc.

OTHER

Other private or publicly owned buildings such as schools, churches, sporting or entertainment facilities.

What’s not project trust work / doesn’t need a project trust account?

A SINGLE HOUSE OR DUPLEX

Small scale residential work – work on a single dwelling such as a house or a duplex where less than 3 living units is involved. Note – if there are multiple houses involved on adjacent sites with the same parties to the contract, a project trust may be required.

WORK THAT’S NOT RELATED TO A BUILDING

Work that is not related to a building – for example civil, mining or infrastructure projects (where less than 50% of the work is related to a building).

Contracts that are only for the maintenance, design or administration of a building (there is no building work included). Note – 100% of the contract must be for this, a design and construct contract may be eligible.

FEDERAL GOVERNMENT PROJECTS

Any work where the principal is the Federal Government.

SHORT TERM CONTRACTS

Short term contracts where the work is to be completed within 90 days or less.

3. When the contract was entered into

There’s a phased introduction of the trust account requirements to enable industry time to adapt to the changes.

PREVIOUS PHASES

1 March 2021 and 1 July 2021 – These phases impacted State Government and Hospital and Health Service projects with only the head contractor needing a trust account. Eligibility is assessed against the date the contract was advertised for tender.

CURRENT PHASE

1 January 2022 – this phase impacts contracts entered into from this date onwards. There is different eligibility criteria depending on the contract value and parties to the contract. A head contractor may require both a project and retention trust account. A principal may require a retention trust account.

FUTURE PHASES

1 April 2025 and 1 October 2025

Trust accounts are due to be rolled out further in 2025 to impact more parties and projects. These phases will impact new contracts entered into from these dates, not contracts that are already underway.

4. The value of the works being completed (total contract value)

As previously explained, there’s a phased introduction of the trust account requirements with the eligibility criteria changing over time. The contract value is only relevant for the project trust account eligibility criteria.

For the current phase the following contracts may require a project trust account:

- State Government and Hospital and Health Service projects valued at $1 million or more.

- Local Government projects valued at $10 million or more.

- Private sector projects valued at $10 million or more.

Note: all contract values are calculated off the excluding GST amount.

5. Whether cash retentions are being withheld

A retention trust account is only required when cash retentions are being withheld.

For the current phase, retention trust accounts are required by principals and head contractors that are withholding cash retentions on project trust projects.

Note: Government entities are exempt from the retention trust requirements.

- Head contractors withholding cash retentions on State Government and Hospital and Health Service projects valued at $1 million or more.

- Head contractors withholding cash retentions on Local Government projects valued at $10 million or more.

- Principals and head contractors withholding cash retentions on private sector projects valued at $10 million or more.

Need further information?

Building Trusts can help you to prepare through detailed training, advice and support.

Find out more at buildingtrusts.com.au.

Call 0481 194 000 or email [email protected].